During its June 19 meeting, the Board of Trustees agenda included:

- Board Adopts 2025–26 Budget

- Bond Oversight Committee Recommendations Approved for Variety of Projects

- Legislative Committee Highlights Key Takeaways from 89th Session

- Pine Becomes Principal of Geiger Compass Center

Superintendent Report

During Superintendent Gearing’s report to the Board, he shared a powerful celebration of Leander ISD’s Graduate Profile—brought to life through the voices and journeys of our students. This video highlights the heart of our district: the students who walk the stage, and the staff, families and community who helped them get there.

More than a graduation, it’s a reflection of what it means to be future-ready, compassionate, and courageous. Watch, share and celebrate the Class of 2025!

Board Adopts 2025–26 Budget

🎬 4.A. Public Hearing on the 2025-2026 Proposed Budget and Tax Rate

🎬 8.B.6. Consider Adoption of the 2025-2026 Budget

Following months of planning and work to provide the resources necessary to support the #1LISD mission, the Board approved the general operating budget for 2025–2026.

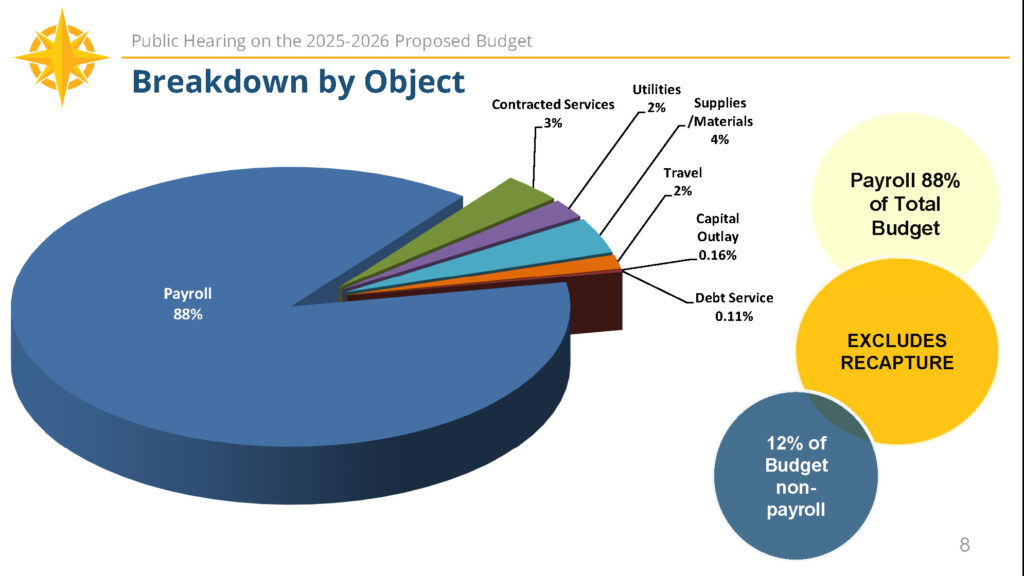

Features of the $481.2 million budget include:

- Support for an estimated 42,500 students

- 88% of operating budget allocated toward payroll

- No across-the-board pay increase for all employees

- Increases for classroom teachers through House Bill 2’s State Retention Allotment

- Classroom teachers with 3 to 4 years of experience receive a $2,500 increase and those with 5-plus years receive an increase of $5,000.

- The salary scale applies to teachers who qualify for the retention allotment. The Texas Education Agency is charged with defining which teachers qualify for the retention allotment.

- Texas Association School Boards (TASB) pay study adjustments

- Funds to establish the police department

- Startup salaries for Early Childhood Development Center

- Increase healthcare contribution

- Payroll and operating reductions totaling more than $15 million

This budget results in a total deficit of $20.2 million, which is within the 4.5% budget parameter approved by the Board in March.

Budgets for the General, Child Nutrition, and Debt Service Funds are included in the official district budget.

2025–26 Tax Rate Proposals

To fund this budget, the tax rate is projected to remain flat at $1.0869 with no change from the previous year. Both the Maintenance & Operations (M&O) portion of the tax rate and the Interest & Sinking (I&S) portion of the tax rate would remain at their 2024-25 levels. The final tax rate is scheduled to be adopted by the Board in August or September.

Previous Updates

- June 5, 2025: Proposed Budget Navigates Impact of HB2, Funding Loss

- May 29, 2025: Legislative Session Nears End with Impacts to Public Education

- May 8, 2025: Board Approves Employee Compensation Package for 2025-26 School Year

- April 24, 2025: Compensation Recommendations Aim to Balance Market Competitiveness, Stabilize Healthcare Costs with Expanded Access

- April 16, 2025: A Leap of Faith: A Message from our Superintendent to our Lawmakers

- March 27, 2025: Approval of Budget Deficit Parameter Adjustment for 2025-26

- March 13, 2025: Budget Discussion Leads to Modified Plan Forward Pending Parameter Adjustments by Board

- Feb. 13, 2025: Budget Development for 2025–26

- Feb. 7, 2025: A Message From LISD’s Board of Trustees Executive Officers

- Feb. 5, 2025: Important Update on Budget and Staffing for 2025-26

- Jan. 23, 2025: Budget Assumptions Approved for 2025–26 Fiscal Year

- Dec. 12, 2024: Preparations Underway for 2025–26 Budget

- Oct. 10, 2024: Budget Process for 2025–26 Starts with Identifying Priorities

Bond Oversight Committee Recommendations Approved for Variety of Projects

🎬 8.B.1. Bond Oversight Committee Recommendations

The Board approved five recommendations of the Bond Oversight Committee (BOC) to move ahead with a series of projects funded through a combination of bond project savings and interest earnings. The BOC met earlier in June and voted in favor of bringing these recommendations to the Board.

ℹ️ Bond Oversight Committee’s process & membership

LED Lighting Conversion at Select Facilities

During the district’s annual budget conversations, district leaders identified converting to LED lighting as a long-term strategy to address rising operational costs without compromising instructional quality or facility performance. Savings from reduced operating costs can then go to fund core instructional needs.

In addition to the financial advantages, this project at approximately 17 LISD facilities will improve energy efficiency and sustainability, reduce maintenance frequency and costs, extend equipment lifespan, and result in fewer work orders.

The Board approved this additional cost toward LED lighting conversion through funds from 2017 Bond interest earnings.

Software-as-a-Service Expenses

A new bill from this legislative session – Texas Senate Bill 58 – permits cloud-based software purchases via multi-year, bond-funded agreement.

Shifting qualifying software from the General Fund to bond funds frees up monies to be used toward employee pay and other items funded through the maintenance and operation side of the tax rate.

Specifically, this plan reallocates up to $8 million from the Bond 2023 line item originally designated for “Interactive Panel Installation” to cover existing cloud-based software subscription expenses currently funded through the General Fund. The plan would be to fund approximately $2 million in annual software expenses over multiple years.

The 2023 Interactive Panel Installation Bond Project has approximately $8.4 million remaining, and all currently needed installations have been completed.

The Board approved qualifying existing cloud-based software subscription expenses be funded with bond project savings.

Replacement of Forklift for Information Technology Services

The BOC recommended the purchase of a replacement forklift for the district’s technology department.

The current ITS forklift supports an 88-bay warehouse, receiving thousands of student and staff devices each year. Manufactured in 1995, the forklift has become obsolete and is no longer

repairable.

The Board approved this additional cost toward a replacement ITS forklift funded out of 2021 Technology Bond interest earnings.

Construction Management Internal Audit

As part of its annual process, the internal audit committee identified Construction Management as one of the areas for next year’s audit.

Given the scale of the district’s building program under the 2023 Bond, the audit is intended to ensure the district remains well-positioned to manage large-scale capital projects effectively.

This audit is preemptive in nature, focusing on assessing the district’s preparedness and internal controls before issues arise – not as a response to any identified deficiencies.

The total cost of the Construction Management audit is $174,742, consisting of $168,742 for internal audit services and $6,000 for related program management support.

The Board approved this additional cost toward a new construction management internal audit funded through 2017 Bond interest earnings.

Emergency Access Improvements at Four Points MS and Vandegrift HS

Following the decision to withdraw a long-pursued federal permit for a new emergency access road, the district confirmed ongoing efforts to enhance emergency access to Four Points Middle and Vandegrift High School.

The BOC recommended changing the scope of work for the 2017 Bond Line Item to be adjusted from “Secondary Access Road” at Vandegrift HS to “Emergency Access Improvements” to explore the feasibility of constructing an interconnected driveway linking Vandegrift HS to Four Points MS for emergency purposes.

The Board approved the change of scope.

Previous Updates

- Jan. 23, 2025: Bond Oversight Committee Recommendation Approved for CPHS Modernization Project

- Nov. 7, 2024: Bond Oversight Committee Recommendations

- May 23, 2024: Bond Oversight Committee Recommendations Approved for Projects Related to Technology, Transportation

- Feb. 1, 2024: Bond Oversight Committee Recommendations Approved for Projects Related to Future Schools, Early College HS, Leander HS Masterplan

- Oct. 26, 2023: Board Approves Bond Oversight Committee’s recommendation of Early Childhood Center

- May 11, 2023: 2023 Building Program Moves Forward Following Successful Bond

- April 13, 2023: Review of Bond Oversight Committee Process & Membership

Legislative Committee Highlights Key Takeaways from 89th Session

🎬 8.A.1. Legislative Committee Update

The Legislative Committee provided a high-level overview of the 89th Texas Legislative Session, spotlighting several bills that will shape district funding, instruction and operations in the years ahead. With more than 1,200 education-related bills filed, many introduce new mandates and financial impacts that LISD is closely monitoring.

While House Bill 2 includes increased state funding in targeted areas, the elimination of “hold harmless” provisions results in a $10 million loss for LISD. Despite overall state investment, the district will see $2 million less in revenue. Additionally, upcoming changes to special education funding and new voucher-related measures will require adjustments in both budgeting and support services.

Highlighted Legislation

- HB 2 – School Finance Overhaul

Boosts teacher pay, early learning and safety funding; removes hold harmless protections, resulting in $10 million less for LISD. - SB 568 / HB 2 – Special Education Funding

Introduces an “intensity of services” model and requires TEA compliance monitoring, not effective until 2026–27. - SB 2 – Educational Savings Accounts (ESAs)

Creates a $1 billion voucher program using public funds; adds burden on public schools for evaluations tied to ESA access. - SB 4 / SB 1453 – Tax Reform and Limitations

Raises homestead exemptions and imposes stricter rules for bond propositions, affecting future facility funding. - HB 1522 / SB 413 – Governance Updates

Expands meeting posting timelines and online transparency requirements. - HB 33 – School Safety (Uvalde Strong Act)

Requires facility security reviews, new tools and enhanced training; supports LISD’s police and emergency management work. - SB 12 / SJR 34 – Parental Rights

Mandates instructional transparency, limits DEI initiatives and requires board responsiveness to parent concerns. - SB 13 – Library and Curriculum Oversight

Tightens standards on library materials and creates new parental access systems and approval processes. - HB 1482 – Cellphone Ban

Prohibits use of phones and smartwatches during the school day.

Looking ahead, the district awaits rulemaking from the Texas Education Agency (TEA), the State Board of Education (SBOE) and others to guide implementation. The district will vet necessary policy changes through its Board Policy Committee, with updates brought to the full Board in future meetings. All bills are subject to the governor’s signature or veto by June 22.

Previous Updates

- June 5, 2025: Proposed Budget Navigates Impact of HB2, Funding Loss

- May 29, 2025: Legislative Session Nears End with Impacts to Public Education

- May 28, 2025: As the 89th Texas Legislative Session Winds Down, A Reflection on Public Education

- May 8, 2025: Legislative Update: Major School Finance Bills Remain in Limbo

- April 24, 2025: Pivotal School District-Related Bills Advance in Texas Legislative Session

- March 27, 2025: Update on the Texas 89th Legislative Session

- Feb. 13, 2025: Dynamic Student Speaker Shines During Legislative Committee Update

- Dec. 12, 2024: Engagement with Community Shapes Advocacy Priorities for 89th Legislative Session

Pine Becomes Principal of Geiger Compass Center

Leander ISD is proud to announce Justin Pine as principal of the Geiger Compass Center, home to the district’s 18+ Transition Services program. Beginning in August 2025, the program will officially relocate to its new building, designed to support students receiving special education transition services between the ages of 18 and 22.